Stuck with IRS debt?

Find Peace of Mind with Our Expert Legal Support for Business Owners and Investors in South Florida

Debt Free in 3 easy steps

Assessment

Account Research

Financial Analysis

Determine Options

Negotiating with IRS

IRS Negotiations

Fix The Client

Clean Up

Monitoring

Finalcial Coaching

Tax Return Preparation

Bookkeeping

Tax Relief is Always Available

Our Tax Attorneys and Tax Professionals are at Your service.

At Moncarz Law Firm, our dedicated team of legal professionals combines expertise, compassion, and relentless advocacy to protect your interests. We work tirelessly to provide personalized solutions for all your IRS challenges.

As Seen In

Sign Up for Tax Monitoring

Dont Delay

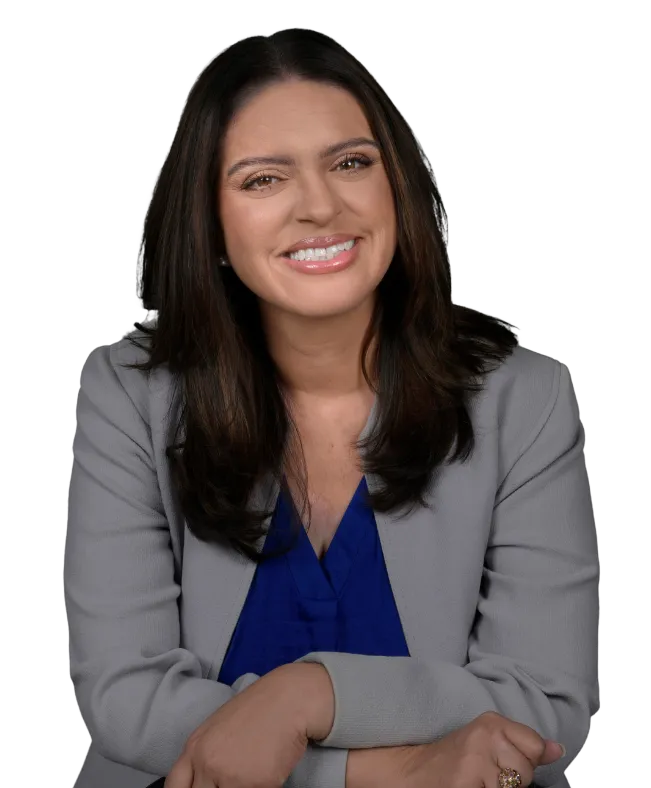

Meet Our Team

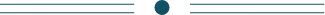

Claudia Moncarz

CEO

Adriana Delgado

Project Cordinator

Fabian Garcia

Lawyer

María José Camarillo

Paralegal

From feeling Debt-Free to being Debt-Free

Navigate the complexities of the tax code with confidence. Our Tax Planning expertise helps you minimize liabilities, optimize financial strategies, and stay compliant, so you can focus on what matters most.

Testimonials

I called a day before and Claudia's agent took all my information so I can have a consultation with her. Honestly I didn't know what to expect on the call. I thought it would be brief and ask me to come have a sit down but Claudia gave me more information than she had to. She was very helpful and if I didn't understand as much she didn't mind repeating herself to make sure I was satisfied before we got off the phone. For that I am truly grateful for the advice she gave me because it led me to getting my problem resolved without having to go toe to toe with the IRS. Claudia I thank you and your front desk assistant for your help. I would definitely recommend this law firm. If there was 10 stars she'd get it all!

Edrique Remy

Position

Company

Claudia Moncarz is an excellent attorney, she takes the time to explain everything so people understand the legal situation and she listens to her clients. She is fast but the most important thing is that she delivers. Ready to use her services again

Evisabel Fabrega

Position

Company

Claudia saved the day for us... the IRS was (wrongly) pursuing me for taxes they claimed I owed and she wiped out about $30k in debt, she was very professional and did a fantastic job - I highly recommend her service!

David L.

Position

Company

100+

Clients

60+

Cases

10M+

Debt Cleared

700

Appeals

Tax News

How a Cooking Technique Can Show You How To Speak to The IRS

I love to cook and learn new cooking techniques. One of those techniques is the concept of “mise en place.” It is a French phrase, which means “everything in its place.” Every chef and professional kitchen implements this concept. The idea is that you prepare your cooking station before you start cooking. Make sure you have all the ingredients you need for the dishes are ready and close before you even begin cooking. This ensures that when you are in the heat of the moment and the kitchen is busy, you can go on automatic pilot. The food will come out just as planned because every single ingredient you needed for the dish was in its place. And this practice can also be used when you are speaking to the IRS.

I understand it can be nerve wreaking when calling the IRS to discuss the collection letter you received. So implement mise en place to the situation to avoid mishaps in the heat of the moment.

So what can you do? Let me give you a short and powerful checklist on how you need to prepare your station before calling the IRS.

Make sure you have your latest IRS correspondence with you and read it one more time.

Write out a quick outline of what you want to accomplish with your call. (Please don’t call the IRS without a strategy or plan. This is not the time to go with the flow or let the divine muse inspire. This call is 100% strategical.)

Make sure you have a pen and paper handy. (I know this sounds redundant, but you will be amazed at what you forget when you are nervous.)

Make sure your phone or cellphone is fully charged and be ready to be on hold for a long time. (Quick tip: Don’t call on Monday. Everyone is calling on Monday.)

Voila. You have the steps you need to follow before you talk to an IRS agent. Stay tune for the next blog post where we will talk about what you need to do when you actually and finally get on the phone with an IRS agent.

Our Commitment goes beyond a single case

Business Planning

Our Business Planning services ensure your company’s foundation is strong and adaptable. From entity formation to succession planning, we provide strategic guidance to help your business thrive and grow.

Tax Planning

Navigate the complexities of the tax code with confidence. Our Tax Planning expertise helps you minimize liabilities, optimize financial strategies, and stay compliant, so you can focus on what matters most.

Book a Meeting

Meet Our Founder

Claudia Moncarz

CEO

I am a world traveler, mother, number lover, and a great attorney (not to toot my own horn). While admittedly I am not that humble, I am proud to be a caring friend to my clients.

I was born in Panama City, Panama but my family was not the kind to remain in one country for too long. There was too much of the world to explore. By age eight I had already lived in Panama, Mexico, and the United States. As an adult, I’ve visited numerous countries throughout Europe, South America, and Asia including China, Kuala Lumpur, Vietnam and still counting.

Even though a love of numbers runs in my family (my grandparents were accountants), I had always shied away from a career related in any way to finance. In fact, my undergraduate major was in English literature. That changed once I got to law school. One summer, I landed an internship working for a criminal judge in Miami, Florida. He quickly realized that I did not want to practice criminal law so he sent me to different divisions to serve other judges.

The week I spent in probate court changed my life. I finally learned what I wanted to do with the rest of my professional life: I was going to be a probate lawyer.

That fall, I shared my new plan with one of my professors. He advised I take a tax course, a recommendation that I reluctantly followed. Thank goodness I did. Studying tax law was like being in nirvana. My love affair with tax law began from that moment. - I guess it was meant to be. After all, it is in genes.

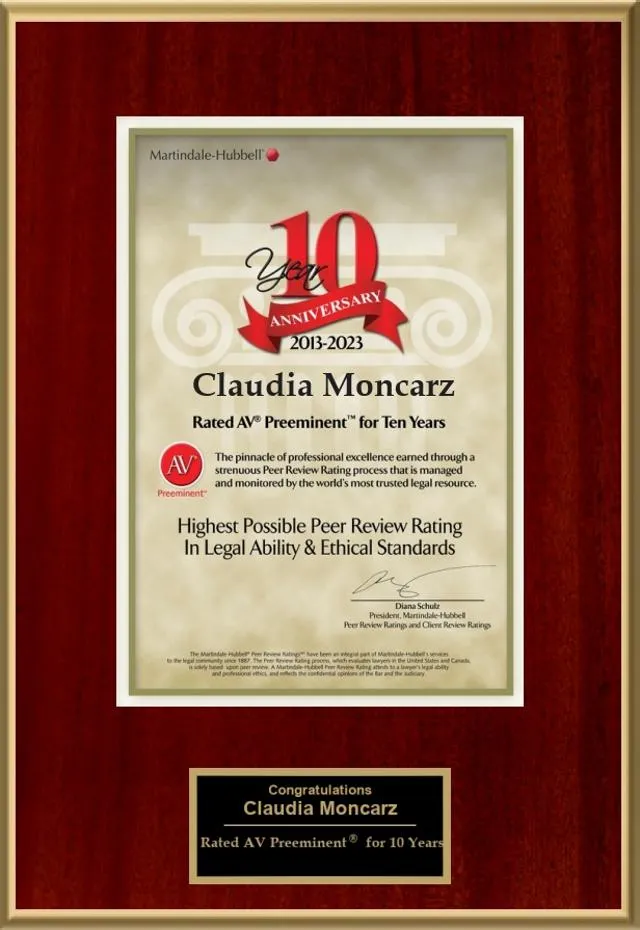

Awards and Accreditation

loading ...