When our clients start the resolution process with IRS, most are surprised by the amount of financial information they have to gather. (Think of it as having to apply for a mortgage.) They quickly notice the IRS’ keen interest in their personal financial affairs. All of a sudden, the IRS wants to know about aspects of their life that you might never have expected them to care about, like housing costs, car expenses, utility bills, groceries, and even their entertainment subscriptions like Netflix. It might leave you wondering why on Earth the IRS would concern themselves with cell phone plans or water bills, but it all comes down to something called Allowable Living Expenses.

You see, the moment you become a tax debtor in the IRS’ eyes, the IRS places an automatic lien against all your possessions, including your future income. And this is the part of the law that allows them to take the various collection actions the IRS can take against you, such as seizing your assets and money.

And because of this lien, the IRS legally has a say in how you spend your money. It’s undoubtedly a frustrating reality, but that’s how the US tax code currently operates. They have the power to make your life a nightmare by enforcing control over your finances and assets. (It is worse than when your mother would not allow you to spend your allowance on basketball cards or concert tickets.)

However, as I always tell you, everything is fixable. There is always a plan B. You see, there are specific protections in place to prevent the IRS from taking everything you have. In simple terms, the IRS is not allowed to drive you into poverty or force your family to suffer because they need to be paid.

This is where the concept of Allowable Living Expenses comes into play. Every year, the IRS conducts an analysis of what middle-class families typically spend on various categories, such as food, clothing, healthcare, transportation, housing, and utilities. The figures they derive serve as a guideline for what they will allow you to spend each month to maintain a “reasonable” standard of living. (I put that word in quotes because it is not always reasonable, but those are the rules you will have to play by.)

Your income, when compared to these allowable standards, determines your eligibility for IRS tax debt resolution programs. If your income is lower than the monthly Allowable Living Expenses for your area and family size, you might be eligible for a program that allows you to pay the IRS nothing at all – yes, that means zero, nada, zilch! On the other hand, if your income exceeds the Allowable Living Expenses calculation, the IRS will consider that “excess” income for a reduced settlement. So, you see it all depends on the monthly Allowable Living Expenses. That is where the magic can happen (or in tax professional lingo – tax resolution planning).

Ok, so let’s delve a bit more into what exactly are Allowable Living Expenses (and in between I will show you some magic).

The IRS breaks Allowable Living Expenses into National Standards and Local Standards. The National Standards, covering food, clothing, and other essential items, are applicable across the nation. You are granted the total National Standards amount on a monthly basis, corresponding to your family size, without scrutiny of your actual spending. Minimum allowances for out-of-pocket health care expenses are also established as National Standards. These standards apply per person, both for you and your dependents, once more without question of the actual expenses incurred by you. On the other hand, the Local Standards, representing maximum allowances for monthly housing, utilities, and transportation, differ based on location. In this case, you will be permitted to claim the amount you actually spend or the local standard, whichever is lower.

Remember how I said here is where the magic happens? Well even though the standards are set amounts, in specific circumstances, the IRS may determine that using the standard amounts is insufficient to cover basic living expenses, leading to the allowance of actual expenses. For instance, if you are a high-end realtor in South Florida, your monthly car expenses may exceed the Local Standards for transportation. You may need a nicer vehicle to drive your clients to appointments. In that case, the argument can be made that the IRS should allow the actual expense and not the Local Standards. Or let’s say you are in the construction industry and you drive a pick-up truck because it can carry all your tools plus it is the proper vehicle to drive around a construction site; once more, the argument can be made that your actual expenses should be allowed as oppose to the lower Allowable Living Expense amount. And this is the kind of argument you want to be able to make so that your actual expenses are more aligned with what the IRS will allow as reasonable monthly expenses (a/k/a Allowable Living Expenses).

So, let’s talk a bit more about the different categories.

National Standards: Food, Clothing, and Other Items

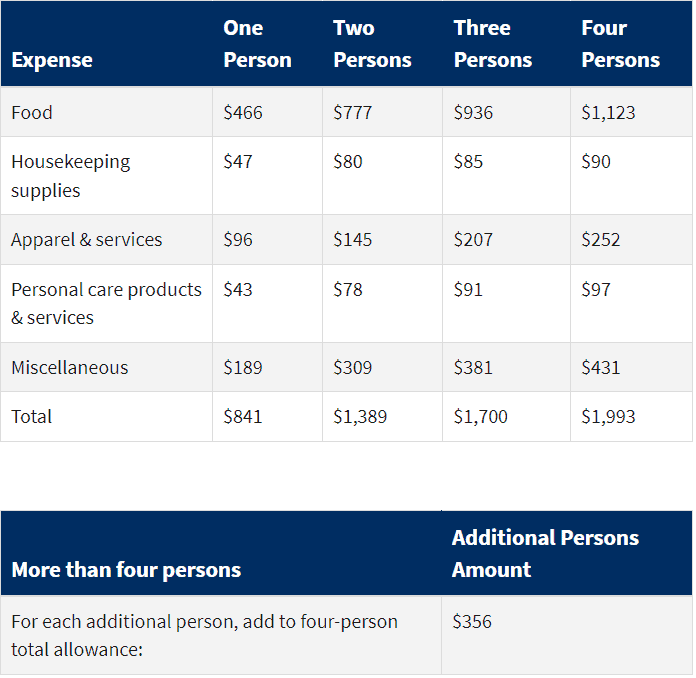

The National Standards: Food, Clothing, and Other Items encompass five crucial expenses, including food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous.

- For food this includes food eaten at home (i.e., groceries) and food eaten away from home (take out, dinners out, etc.).

- For housekeeping supplies, it not only includes laundry and cleaning supplies, but also, miscellaneous household products, and lawn and garden supplies.

- Apparel and services include clothing, footwear, material, clothing rental, clothing storage, dry cleaning and sent-out laundry, watches, jewelry, and repairs to watches and jewelry.

- Personal care products and services include products for hair, oral hygiene products, shaving needs, cosmetics, and bath products, electric personal care appliances, and other personal care products.

- The miscellaneous allowance is a catch all category that includes expenses that you may incur that are not included in any other allowable living expense items. You can use the miscellaneous allowance to pay for expenses that exceed the standards, or for other expenses such as credit card payments, bank fees and charges, reading material, and school supplies.

For 2023, the National Standards: Food, Clothing, and Other Items is:

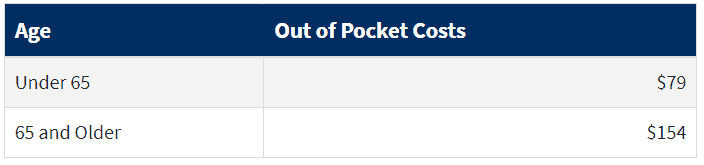

National Standards: Out-of-Pocket Health Care Expenses

For National Standards: Out-of-Pocket Health Care Expenses, the IRS has set specific standards to cover your medical services, prescription drugs, and medical supplies like eyeglasses and contact lenses. These standards allocate an average amount per person and their dependents depending on whether they are 65 years old or older.

For 2023, the National Standards: Out-of-Pocket Health Care Expenses is:

However, a little note here, while there is a set National Standards for medical expenses, it your medical expenses are higher than the set amount, then IRS will let you deduct the higher amount, provided you have backup documentation to prove you paid those higher medical expenses.

Local Standards: Housing and Utilities

Just like the National Standards, the Local Standards are derived from data provided by the U.S. Census Bureau, American Community Survey, and BLS. However, unlike the National Standard, the Local Standards are based on the area where you live. For the Local Standards: Housing and Utilities, it is actually based on not only the state you live, but actually the county. (Yes, that granular.) These standards cover a range of essential expenses, such as mortgage or rent, property taxes, utilities, telephone services, cable television, and internet services. And they vary by state and at the county level. After all, what you pay for rent in Gainesville, Florida, is not the same as what you pay in Miami, Florida. For instance, the maximum allowable housing expenses for a family of four in Miami-Dade County is $3,053, and in Alachua County is $2,345. Big difference!

But remember what I mentioned earlier, for this area you are allowed as an expense the lower of the maximum allowable housing expense or your actual cost. And you may need to sow the IRS proof of your actual expenses depending on how much you owe or what resolution you are trying to get to.

Local Standards: Transportation

Now let’s move on to Local Standards: Transportation. Here, you will encounter a dual structure. The first part comprises nationwide figures for monthly loan or lease payments, known as ownership costs. Complementing this, additional amounts are assigned for monthly operating costs, categorized by local areas. A little note here, for a family, ownership costs accommodate maximum allowances for leasing or purchasing up to two automobiles, depending on their necessity as an expense.

This means if you are a family of three or more with a college-aged child, your child’s third car is not an allowable deduction. See, this is why I put reasonable in quotes. How is your child supposed to get to classes and you and your spouse to work in different areas of town at the same time?

As to operating costs, it encompasses maintenance, repairs, insurance, fuel, registrations, licenses, inspections, parking, and tolls. If you have a car payment, the allowable ownership cost is added to the allowable operating cost to determine the allowable transportation expense. On the other hand, if you are without a car payment, only the operating costs portion of the transportation standard comes into play. In both cases, you are granted the lesser amount between what you actually spent and the standard.

Additionally, there is a single nationwide allowance for public transportation that is allowed for mass transit fares for trains, buses, taxis, ferries, and more. If you don’t own or lease a vehicle, a standard is provided per household, with no questioning of the actual expenses incurred. However, if you own or lease a vehicle but also rely on public transportation, expenses for both can be allowed. However, in such cases, the allowed expenses would be the actual incurred costs for ownership, operating, and public transportation, or the standard amounts – whichever is less. You see this applied more up north in such cities as DC and New York, where it is easier to commute to work through public transportation than using your own car.

As you can see, while it may seem like the standards are a set of numbers, you can do some tax resolution planning when it comes to Allowable Living Expenses. You need to know what your arguments are so that your expenses are more aligned to what the IRS will allow. This is the reason why when clients hire us to assist with their tax debt problems, we conduct a detailed financial analysis similar to what the IRS does. We do this for several reasons:

- To determine which IRS programs you’re eligible for;

- To explore legal and ethical ways to increase the Allowable Living Expenses numbers in your favor; and

- To identify unique circumstances that might open doors to alternative resolution options.

And this is exactly what you want to do for you because this type of financial analysis is critical in securing the best possible outcome you. Since most people with that tax debt end up on a monthly payment plan (and this may be what you end up with), your goal should be to secure the smallest possible monthly payment, minimizing the short-term financial impact on your budget.

And remember if you find yourself in a situation where the IRS is pressuring you for detailed personal financial information like this, it might be time for us to have a chat. The last thing you want is to be trapped in a situation that’s only convenient for the IRS, leaving you unable to meet your other monthly obligations. Simply schedule a time to talk with us, and we’ll work together to find the best resolution for your tax debt situation.

Click on the link below to set up a time to speak.